What is a Pay Stub Template?

Pay stubs, also known as paycheck stubs, are documents that show details of the employee’s wages. The pay stub documents the hours worked by the employee, wages earned and the deductions made from the total pay, be it for tax purposes or others.

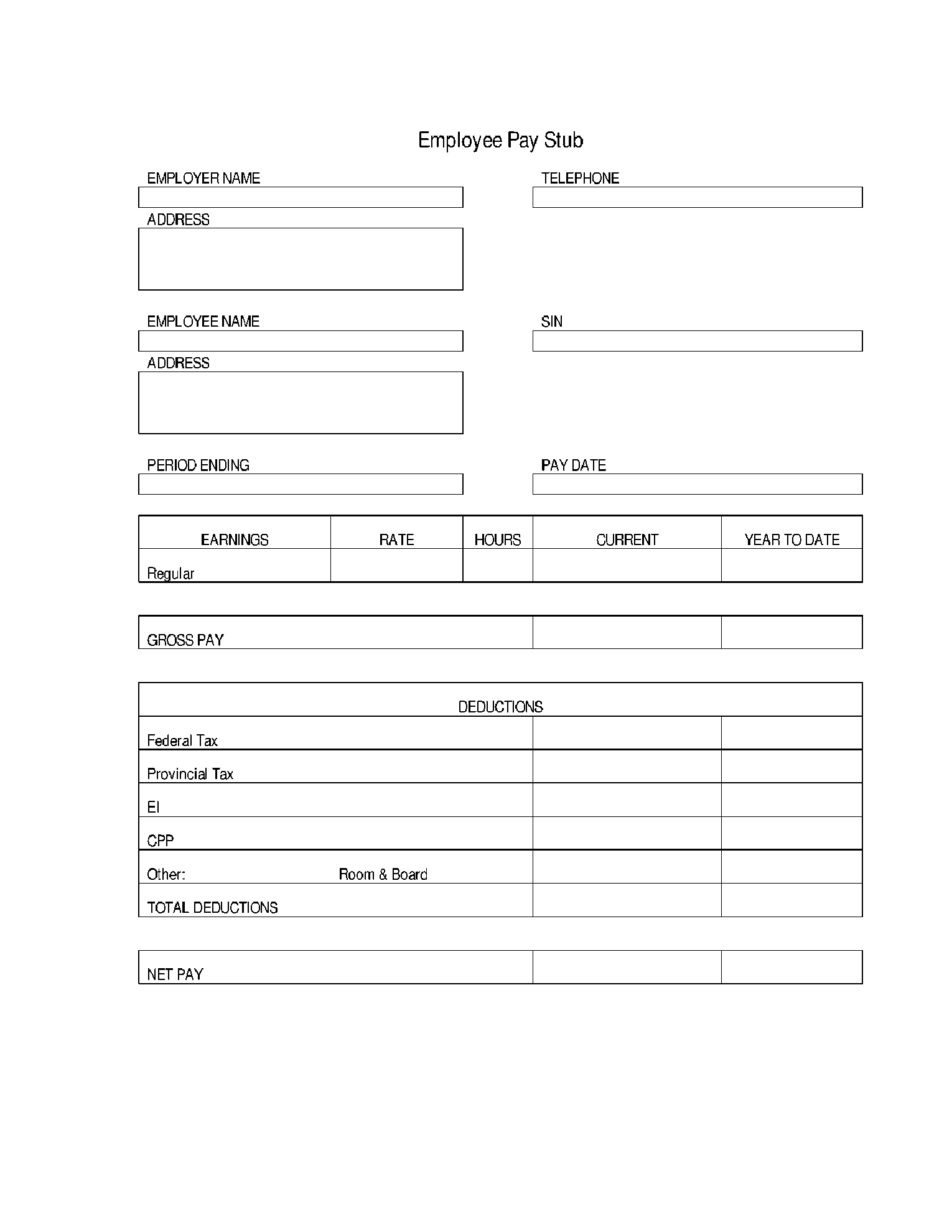

The pay stub template is used to document and store the details of the worker’s job in an organized manner. Users can use our employee pay stub template to prepare their workers’ monthly/weekly pay schedule.

The easy-to-use template allows businesses/users to document important monetary things. Users can itemize pay-period information and use these stubs to better understand how much of their salary goes to tax, their pay rate per hour, gross earnings, and other deductions.

Now instead of just getting a simple check where you couldn’t tell how much of your pay went to tax or why some amount was deducted, the pay stub completely describes the going ins of wages

Information Required for a Pay Stub

Filling a pay stub is extremely easy. However, before filling the stub, make sure you have gathered all the information necessary. Below we have compiled all the information you may need to fill out your form.

-

- Employer's Name

- Telephone

- Address of the job

- Name of the Employee

- Address of the Employee

- Wages

- Employee Work Hours

- Tax Applicable (federal/provincial)

- Personal Information

- Pay Rate and Hours

- Deductions

How to fill Employee Pay Stub?

Filling the pay stub using our template is very easy. Our stub uses precise words and strategic placements to make the template user-friendly

Step 1: Personal Information

This section contains all the information related to the job of the worker. Their starting dates, dates when they get paid, hourly/monthly pay, and hours pitched in.

Box 1: Add the employer’s name in this box. Don’t enter the employee’s name.

Box 2: Provide the workplace telephone number.

Box 3: Enter the Workplace address. Do not add any other address.

Box 4: Enter your employee’s name.

Box 5: Provide the Social Insurance Number in box 5.

Box 6: Provide the current address of the employee.

Box 7: Enter the duration of the employee’s job. Mention when it will end.

Box 8: Provide the date when you will be paying your workers their wages.

Step 2: Wages

This section includes the hourly rate of pay, regular earnings, and so on

Box 1: in this box, you need to enter the regular earnings of the worker.

Box 2: mention the rate of earnings.

Box 3: provide the accurate amount of hours worked by an employee.

Box 4: enter the current hours worked by the employee.

Box 5: provide the year to date.

Box 6: in this box, you need to enter the gross pay of your worker.

If you are wondering what gross pay is, we will explain. A Gross Pay is the amount of your salary when no payroll deductions have been made.

In this section, users need to add the total amount of the pay when no federal/provincial or other deductions have been made.

Step 3: Deductions

This section covers all the taxes that will be applicable to your pay. These can also be deductions made for health insurance or life insurance.

The taxes that are withheld from your pay are usually federal income tax, provincial/local tax.

Box 1: Mention how much is the total federal tax.

Box2: Enter the provincial tax that applies.

Box 3: Enter the EI amount.EI means Employment Insurance. This is the amount that the employer will pay his employees if he becomes unemployed. It is a temporary payment.

Box 4: Enter CPP value in this box. CPP stands for Canada Pension Plan. Workers above 18 years old and less than 65 years old are employed on pensionable employment. The employer will deduct this much amount from the pay.

Box 5: Enter the amount of any other deductions that need to be made such as rent, room, or food if you are providing them.

Box 6: Enter the total sum of all the deductions made.

Box 7: Mention the net pay of the workers after taxes/deductions have been made. This is the amount of money you will pay the workers.

All these deductions need to be clearly mentioned in a pay stub.

Why is a Pay Stub Template Required

A Paystub can be a very useful thing when running a business.

-

- For an employer, the pay stub can be useful for tax purposes.

- Pay Stub provides details regarding gross pay, net pay, how much of the tax was deducted and what kind of tax was deducted.

- Pay Stub can help clear any discrepancies with employee pay, making it easier to keep a clean track of how much of a profit you earned and how much of the money went to employee’s wages.

- Pay Stub can be used by workers to apply for a loan/credit when required.

- It is a means of security and proof of income or employment over which a loan can then be acquired. Using pay stubs will not only save you money but help record the money tracks more efficiently.

All the above mentioned reasons emphasize the need for a good employee pay stub. What are you waiting for? Go paperless and save yourself from the mess with our pay stub form. Get the best pay stub template and get your work done easier!

Additional Resources for Pay Stub Template

If you are still a bit confused, use the resources provided below! Each explains in detail how to fill a pay stub template.